Introduction

There is no doubt you would have heard about productivity in the workplace on numerous occasions. Maybe some have attended conferences, webinars, or seminars on refining and optimising routines to reach the standard of efficiency required by your staff.

The context of every business situation changes the solution. Due to this, there is never a right or wrong way to achieve optimal productivity in the workplace; however, within specific sectors, we see common traits that, if implemented correctly, can work as guidance.

In this insight, our focus will be on the finance and accounting sectors. How the speed of workplace change has left many businesses lagging in productivity, and how the two can work together.

Modernising your business is a constant iterative process. It will never be completed and will always require chipping away. The simple definition of productivity measures how well you nurture and provide for your employees against the value to drive growth and profit.

Imagine a workplace where everyone understands their job role, works towards the same values and principles, are super-efficient and meaningful with their work, and morale is excellent. This is how you can improve productivity in the modern workplace.

This post is an exerpt taken from our Business Guide for Finance and Accounting companies. You can download your free copy of the guide by clicking the link below.

Processes, Efficiency & Workflows

How do large multi-national companies such as McDonald’s keep everything to a set standard and function so well? We’re not saying that we want to be like them, but they do so well by creating processes and standard to follow and capitalising on efficiencies.

They take it to the extreme need for their industry. Absolutely everything has a process, absolutely everything is as efficient as possible. Workflows and just-in-time delivery systems reduce wasted time and materials.

The takeaway here is to never under-estimate processes or workflows, they provide a platform for everyone to follow in the same direction. Some processes and workflows to consider (if you haven’t already got them) are:

- Staff Onboarding / Offboarding

- New client or supplier setup on internal systems

- SOPs – Standard Operating Procedures – document everything you do so there is a standard and you are not re-inventing the wheel each time

Recommended Tip: Have a read of E-myth Revisited by Michael E. Gerber. The book has valuable insights on how to work on your business and not in your business.

Digital Transformation & Collaboration

In 2016 the financial sector was on the cusp of a full digital transformation. A Deloitte survey found that 90% of respondents agreed that digital technology disrupts the industry to a great or moderate extent. That was six years ago.

ESG reporting and investments in Sustainability will drive Cloud migration and purchasing decisions by 2025.

Since the publication of that survey, the finance sector has undergone a radical change at a speed that shows little signs of slowing. Change has been so widespread that the then CFO of JPMorgan Chase announced to investors, “We are now a technology company”. This was a bold statement that now rings true for many.

Pre-pandemic, there were calls for change amongst SMEs to remain competitive, but most businesses have still not fully embraced this. Another constant iterative process that you cannot ignore. Key areas to factor into digital transformation are:

- Payment Processing

- Customer Service

- Data Analysis

- Document Processing

- Onboarding

- Office Processes and Regulation

Beyond 2022 we should keep a close eye on trends such as.

- Open Banking

- Cloud Applications

- Cryptocurrency

- Self-Services Technology

What can you do to get your systems up to speed on this front? Collaboration is the key to successful digital transformation strategies.

Get everyone to work together to help decide on the digital technologies needed and how to create new (or modify existing) business processes, culture, and customer experiences to meet changing business and market requirements.

A great starting point is to speak to your existing customers and find out their needs and demands as they become exposed to the changes in technology. Use the feedback you receive wisely and handpick a few of your top customers to trial new technology to understand the long-term value of a full rollout.

A Side Note: Digital transformation is an evolving topic. The change will represent different paths for every business owner; embrace this. The critical element here is collaboration; this is a must as it sets the context for the change you need, short and long-term.

69% of employees say the number of business apps / software has increased during the pandemic.

2021 Workforce Trends Survey

Automation / Streamlining Systems

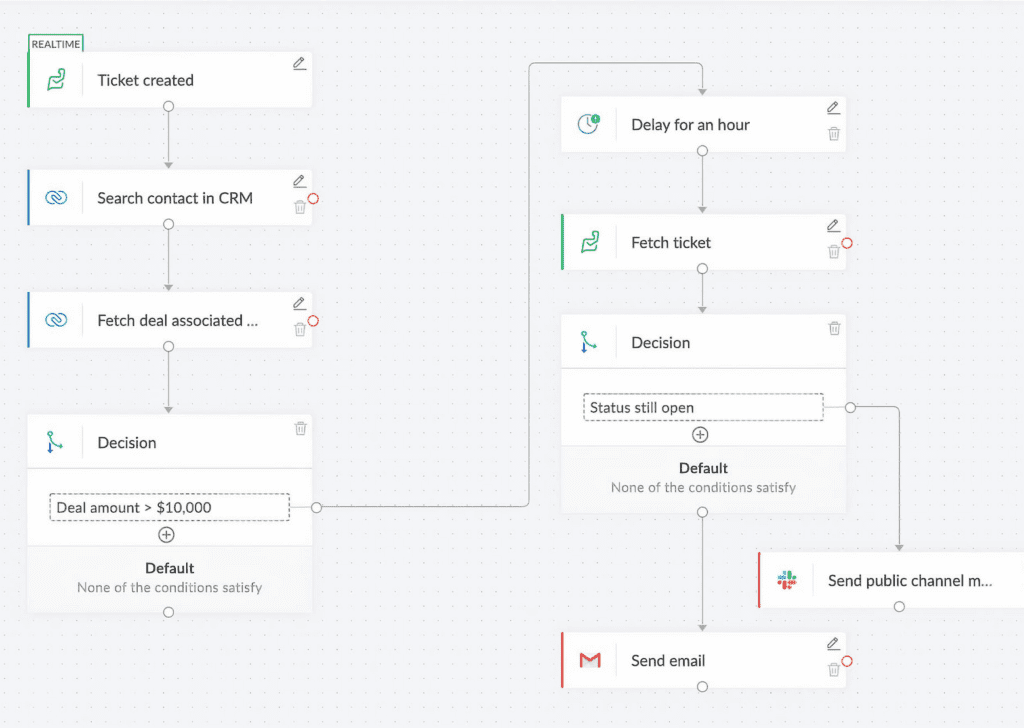

Automation can immediately improve business performance if used correctly. The art of automation is to limit errors and improve quality. This is done at a task level, reducing the risk of human errors.

When considering automating processes or procedures within your business, ask how your processes can be fine-tuned to flow from one person/team/department to another. How can this be turned into something that happens automatically?

Automation works best with systems and built-in technology to tell it what to do and when to do it. It will be from a CRM system if this relates to your customers.

With the understanding that you have a CRM system of sorts implemented, you can use automation to be the AI that provides:

- 5-star customer service

- Personalisation that trumps your competitors

- The seamless integration of big data

The list of tasks you can look to automate is endless. Below we have listed some of the most popular systems and software used in the financial sector and a link to their automation guides. Use this as a place to start brainstorming on what works for you.

- FIS Global: Automation with Prebots

- Oracle: Cloud Process Automation

- Microsoft Azure: Cloud Management Automation

- Zoho: Workflow Automation

- Xero: Automation Tips

- Quick Books: Accounting Processes Automation

Recap Points

Seriously, do not underestimate the power of a process and then fine-tune and automate the process as much as possible. What can be overhauled and replaced with something better? Are you using the best tools you can afford that can impact change today but also the transformation of tomorrow?

Look at a partnership with an excellent technology partner who will put a process in place to manage this and schedule regular business and IT reviews.